We have previously considered the impact on sole traders and partnerships of the proposed basis period reform (which is part of the government’s plans for Making Tax Digital for Income Tax Self Assessment. This reform was originally due to take effect in the 2022/23 tax year but has now been deferred until 2023/24. This means that there is still time for accountants and their clients to consider the position if their year-end is not coterminous with the tax year and to take steps to minimise the impact of the new measures.

How are the rules changing? A reminder Currently, self-employed individuals and members of partnerships are charged Income Tax on the profits arising from their activities. Ordinarily, the profits arising in the accounting period which ends in a tax year are taxed. So, for a business with a June accounting year end, the tax liability for the 2022/23 tax year will be those arising in the year ended 30 June 2022.

This is known as the ‘accounting year basis’. However, these rules can be complex, especially in the opening years of a business. It can also lead to a time-lag between profits being earned and when tax is due. In the example above, tax would not be due on the profits for the period from 1 July 2021-30 June 2022 until 31 January 2024.

This reform changes the taxation of profits to a ‘tax year basis’ with effect from the tax year 2024-25, so that a business’s profit or loss for a tax year is the profit or loss arising in the tax year itself, regardless of the business’s accounting date. 2023/24 will be the transition year from the current accounting year basis to the new tax year basis. During the transition year, many businesses will experience double taxation. This is because they will be taxed not only on 12 months’ worth of profits from the end of the previous 2022/23 basis period, but there will also be additional ‘transitional profit’ to bring the figures in line with the tax year.

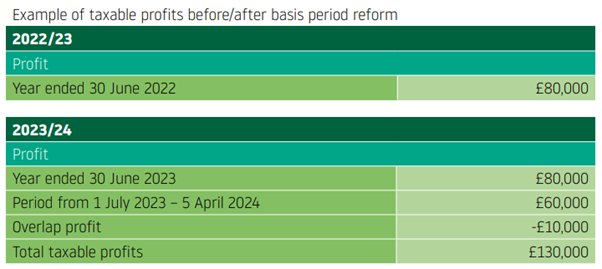

Let’s take an example of a partner who has an annual profit share of £80,000 and the partnership accounts are drawn up to 30 June. The overlap profits brought forward are £10,000. The taxable profits in the 2022/23 and 2023/24 tax years would be as shown on the previous page. This is likely to present huge challenges to cash flow and a corresponding reduction in the cash available for drawings. To assist with this, the ‘excess profits’ in the transition year (£50,000 in the above example) can be spread across five years, meaning tax is paid on an extra £10k profits each year from 2023/24 – 2027/28 inclusive.

How will it impact farming clients?

Farmers and their advisers already must factor farmers’ averaging and the hobby farming rules into any tax planning and the basis period reform will add a further layer of complexity. Combined with the fact that many farmers are embarking on diversification projects, farmers’ tax has never been so complicated! Whilst any transitional profits will be ignored for farmers averaging calculations, some farmers and landowners could still find themselves tipped into a higher tax bracket because of the accelerated profits.

As seen in the example above, any ‘overlap profits’ from the early years of the business can be used to reduce the taxable profit in the transition year. Farm accountants will therefore need to identify available overlap profits sooner rather than later. However, with many family farming businesses having been set up before the advent of Self-Assessment in 1996, locating the paperwork to determine the correct overlap position may not be straightforward.

Should farmers change their year end?

If a farmer decides to adjust their year-end ahead of the reform, careful consideration should be given to the potential impact on their averaging calculations. With regards to the ‘hobby farming rules’ (which historically have stated that a profit must be made every six years), these must be calculated in accordance with the tax year. Moving to a coterminous year end will therefore make it much simpler for the farm accountants to ensure they do not fall foul of the loss restriction rules.

There may be accounting issues to overcome if farmers wish to align their accounting period to the tax year (eg stock valuations). The opportunity for post year-end tax planning is made more difficult with a co-terminous year end. In the example above where accounts are drawn up to 30 June, the partners then have until the following 5 April to decide how much they should put into their pension. This 9 month ‘planning window’ would disappear with a 5 April year end. It could, however, also cause complications for farmers if their current year end is retained; the complexities of changing to a tax year end might simply be replaced with different (and potentially greater) complexities of having to apportion profits and arrive at estimates for tax returns.

If a farmer is planning some big equipment purchases, an extended trading period may not result in much (if any) additional tax. In this case, there would be an argument in favour of changing the year end ahead of the proposed reforms, particularly with the £1m Annual Investment Allowance (AIA) now available until 31 March 2023.

How can we help? At Scrutton Bland, our team can forecast any additional tax liabilities that might arise as a result of the proposed reforms and consider whether it would be advantageous for you to change your year end. We can also suggest planning opportunities that may lower the amount of tax due (eg the timing of the acquisition of plant and machinery) and assist you if you are considering incorporating your business. Please reach out to a member of the team to dicsuss this further.