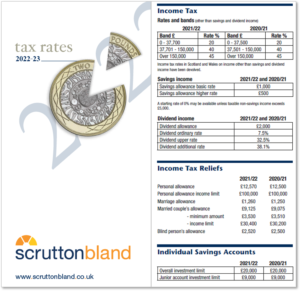

Our Tax Card for 2022/23 breaks down the most important rates and allowances, both personal and business, that you should be aware of over the coming year.

Click on the image above to access and download our 2022/23 Tax Card

It contains lots of information on

- Personal Tax Allowances

- National Insurance

- Car, Van and Fuel Benefits

- Stamp Duty Land Tax

- Capital Gains Tax (CGT)

- Inheritance Tax (IHT)

- Corporation Tax, Value Added Tax (VAT)

- Pension Allowances

- Key Dates and Deadlines